Categorie

- Accesorii si componente biciclete

- Chimice

- Cuie/Sârmă/Electrozi

- Dispozitive si sisteme de iluminat

- Drujba si motocoase – piese si componente

- Echipamente de protectie

- Electrice

- Fără categorie

- Feronerie

- Fitinguri

- Incendiu și PSI

- Instalatii gaz

- Instalații sanitare

- Accesorii instalatii sanitare

- Accesorii baie

- Accesorii baterii

- Accesorii cada

- Accesorii calorifere

- Accesorii chiuvete

- Accesorii etansarea instalatii sanitare

- Accesorii rezervoare wc

- Accesorii vase de expansiune

- Accesorii vase de wc

- Aerisitoare

- Console chiuvete

- Filtre / purificatoare

- Garnituri instalatii sanitare

- Kit de siguranta instalatii

- Supape de sens

- Supape de siguranta

- Apometre

- Bacuri de sudura

- Baterii baie

- Baterii bucatarie

- Chiuvete inox

- Distribuitoare

- Obiecte sanitare

- Presostate

- Racorduri

- Rezervoare de wc

- Termomanometre

- Termostate

- Usite de vizitare

- Vase de expansiune

- Accesorii instalatii sanitare

- Mobilier baie

- MOTOARE ELECTRICE

- Organe de asamblare

- Agatator

- Ancore

- Banda reparatii

- Belciuge

- Benzi adezive

- Benzi mascare

- Benzi perforate

- Benzi protectie

- Benzi rigips

- Bride

- Carabine

- Chei tachelaj

- Cleme

- Coliere strangere / fixare

- Coltari aluminiu

- Colțari, plăci perforate și papuci reazem

- Conexpanduri

- Dibluri

- Distantiere

- Garnituri

- Lanț comercial

- Piulite

- Prelungitoare tije filetate

- Roti pentru carucioare

- Șaibe

- Sigurante de fixare

- Suruburi

- Pompe recirculare

- Pompe si hidrofoare

- Reductoare de apa

- Robineti

- Scule si unelte

- Abrazive, perii din sârmă

- Accesorii curatenie

- Amestecatoare

- Amplificatoare de forta

- Aparate cu jet de apa

- Aparate si accesorii pentru slefuit

- Aparate si accesorii pentru sudura si lipit

- Aspiratoare

- Bancuri de lucru

- Banda adeziva

- Benzi izolatoare

- Benzi mascare

- Biti

- Bormasini si accesorii bormasini

- Burghie

- Capsatoare si capse

- Chei combinate

- Chei cu clicket

- Chei fixe

- Chei franceze

- Chei hexagonale

- Chei inelare

- Chei pentru bujii

- Chei pentru tevi

- Chei pneumatice

- Chei reglabile

- Chei tubulare

- Ciocane

- Clesti

- Compresoare

- Cutii pentru scule, organizatoare

- Dalti, dornuri

- Dispozitive de gresat

- Dispozitive de transport

- Filiere, tarozi

- Generatoare

- Instrumente de masura si control

- Menghine

- Pile, polizoare

- Pistoale cu aer

- Pistoale pentru silicon

- Pistoale pentru spuma

- Prese

- Roabe

- Scripeti, corzi, sfori…

- Scule depanare auto

- Scule pentru cuie

- Scule pentru marcari

- Scule pentru taiat, decupat

- Scule pentru vopsit

- Scule pentru zidarie

- Scule speciale

- Scule tamplarie

- Surubelnite

- Surubelnite electrice

- Sisteme de avertizare

- Țeavă

- Uz casnic si gospodaresc

Filtrare produse

Information Credit scores and Financing

When it comes to protecting that loan, facts fico scores is very important. Credit ratings gamble a crucial role in the deciding loan qualifications and you will interest levels. Within this section, we will speak about the significance of credit scores in addition to matchmaking between credit ratings and mortgage approval.

Significance of Credit ratings

Fico scores try a mathematical logo off a person’s creditworthiness. Loan providers use credit ratings to evaluate the chance associated with the financing money in order to a borrower. A top credit history means less chance debtor, whenever you are less credit history indicates a high risk.

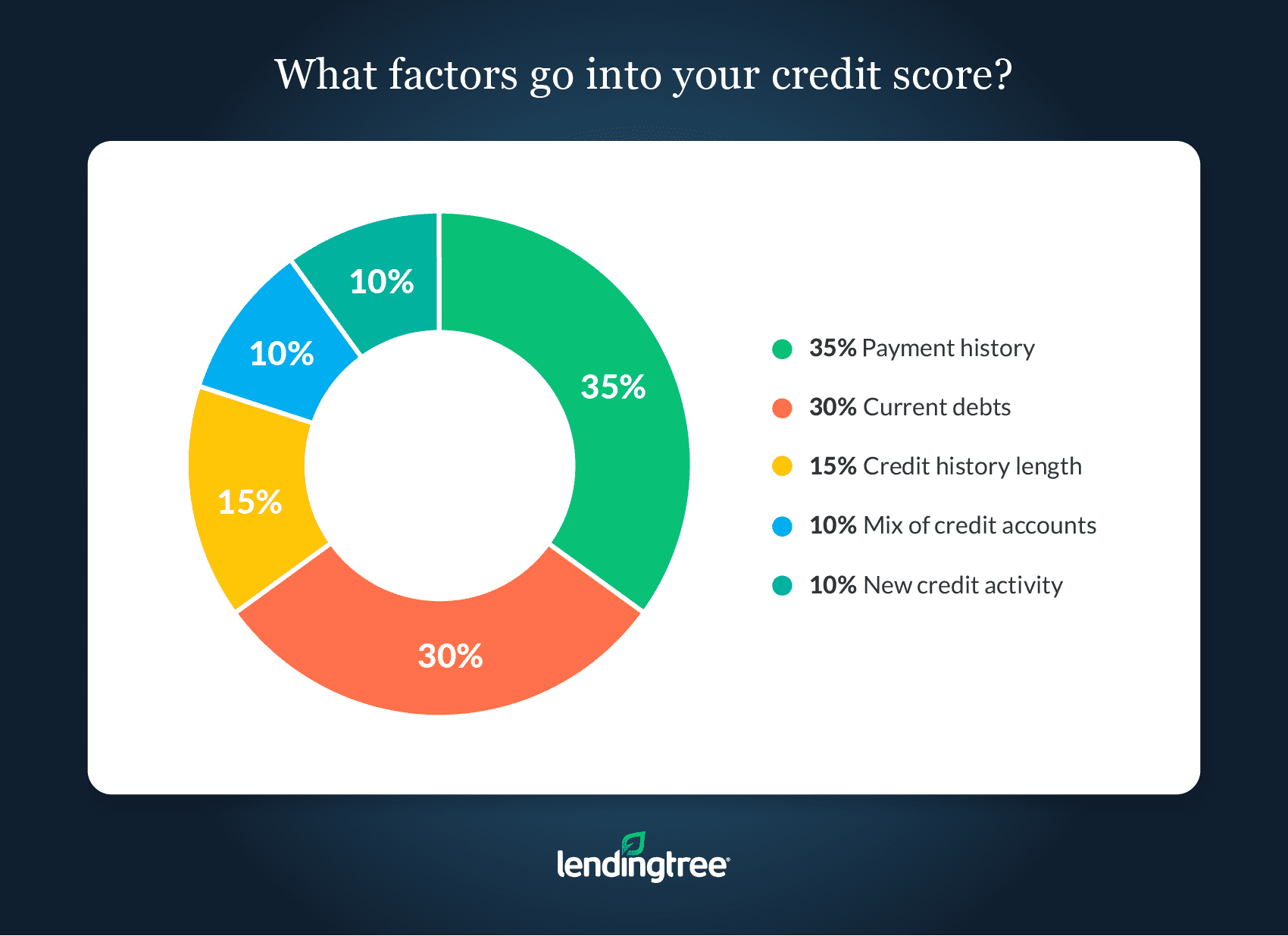

Credit ratings was calculated predicated on certain situations, along with percentage payday loan online Meridian Village CO record, borrowing from the bank application, duration of credit score, form of borrowing from the bank, and you may the borrowing from the bank programs. By far the most widely used credit reporting model is the FICO rating, and therefore ranges regarding 300 to 850. Essentially, a higher credit rating indicates a far greater credit rating and you will an effective deeper probability of mortgage recognition.

Loan providers rely on credit ratings making informed decisions in the loan approvals, rates of interest, and you can financing terms and conditions. Good credit is open doorways to help you good mortgage alternatives that have lower rates of interest, while you are a poor credit rating can be limitation loan options and you can result into the highest rates of interest.

Matchmaking Anywhere between Credit scores and you can Financing Approval

Credit ratings has actually a positive change towards mortgage recognition. Lenders thought fico scores while the indicative out of an individual’s ability to repay the loan. Whilst each lender sets a unique criteria, a credit history from 550 tends to be said to be fair or terrible, that may perspective pressures whenever seeking a loan.

A decreased credit rating can make it tough to be eligible for traditional bank loans or other antique loan providers. Although not, it’s important to keep in mind that credit scores are only one factor sensed in loan acceptance procedure. Loan providers and additionally see earnings, work background, debt-to-earnings ratio, or any other factors to determine your creditworthiness.

Having a low credit score doesn’t invariably indicate that securing an excellent loan was hopeless. You will find certified loan options available for individuals with lower borrowing ratings, such as for example secured personal loans, cash advance, and online loan providers. These businesses could have some other eligibility conditions and may feel happy to do business with consumers who possess a beneficial 550 credit rating.

Understanding the requirement for fico scores as well as their impact on financing acceptance is vital for those that have an excellent 550 credit history. Of the exploring alternative mortgage options and getting steps to change borrowing ratings, consumers can increase their chances of securing financing and you can probably improving their credit standing through the years.

Perception off a great 550 Credit rating

With respect to obtaining a loan, your credit score plays a serious role into the deciding the qualification plus the conditions you may be eligible for. A credit rating off 550 is recognized as being regarding straight down range, that impact your ability in order to safe a loan. Why don’t we explore the standards one to determine financing approval while the pressures it’s also possible to deal with which have an excellent 550 credit score.

Situations Impacting Financing Recognition

Loan providers evaluate certain factors when considering a loan application, and your credit history the most essential issue. A credit rating reflects the creditworthiness and you can ways the amount of exposure from the lending your money. Whenever you are a good 550 credit score may not completely prohibit you from financing recognition, it does notably limit your choice and you may impact the words given.

Including your credit rating, loan providers also consider other variables such as your money, a position history, debt-to-income ratio, and you may people equity you might give. These situations assist loan providers determine your capability to settle the mortgage and come up with a credit choice.

Lasă un răspuns