Category

- Luracontex

- MOTOARE ELECTRICE

- Accesorii si componente biciclete

- Cuie/Sârmă/Electrozi

- Chimice

- Dispozitive si sisteme de iluminat

- Drujba si motocoase – piese si componente

- Echipamente de protectie

- Fără categorie

- Electrice

- Fitinguri

- Feronerie

- Incendiu și PSI

- Instalatii gaz

- Instalații sanitare

- Accesorii instalatii sanitare

- Accesorii baie

- Accesorii baterii

- Accesorii cada

- Accesorii calorifere

- Accesorii chiuvete

- Accesorii etansarea instalatii sanitare

- Accesorii rezervoare wc

- Accesorii vase de expansiune

- Accesorii vase de wc

- Aerisitoare

- Console chiuvete

- Filtre / purificatoare

- Garnituri instalatii sanitare

- Kit de siguranta instalatii

- Supape de sens

- Supape de siguranta

- Apometre

- Bacuri de sudura

- Baterii baie

- Baterii bucatarie

- Chiuvete inox

- Distribuitoare

- Obiecte sanitare

- Presostate

- Racorduri

- Rezervoare de wc

- Termomanometre

- Termostate

- Usite de vizitare

- Vase de expansiune

- Accesorii instalatii sanitare

- Mobilier baie

- Organe de asamblare

- Agatator

- Ancore

- Banda reparatii

- Belciuge

- Benzi adezive

- Benzi mascare

- Benzi perforate

- Benzi protectie

- Benzi rigips

- Bride

- Carabine

- Chei tachelaj

- Cleme

- Coliere strangere / fixare

- Coltari aluminiu

- Colțari, plăci perforate și papuci reazem

- Conexpanduri

- Dibluri

- Distantiere

- Garnituri

- Lanț comercial

- Piulite

- Prelungitoare tije filetate

- Roti pentru carucioare

- Șaibe

- Sigurante de fixare

- Suruburi

- Pompe recirculare

- Pompe si hidrofoare

- Reductoare de apa

- Robineti

- Scule si unelte

- Abrazive, perii din sârmă

- Accesorii curatenie

- Amestecatoare

- Amplificatoare de forta

- Aparate cu jet de apa

- Aparate si accesorii pentru slefuit

- Aparate si accesorii pentru sudura si lipit

- Aspiratoare

- Bancuri de lucru

- Banda adeziva

- Benzi izolatoare

- Benzi mascare

- Biti

- Bormasini si accesorii bormasini

- Burghie

- Capsatoare si capse

- Chei combinate

- Chei cu clicket

- Chei fixe

- Chei franceze

- Chei hexagonale

- Chei inelare

- Chei pentru bujii

- Chei pentru tevi

- Chei pneumatice

- Chei reglabile

- Chei tubulare

- Ciocane

- Clesti

- Compresoare

- Cutii pentru scule, organizatoare

- Dalti, dornuri

- Dispozitive de gresat

- Dispozitive de transport

- Filiere, tarozi

- Generatoare

- Instrumente de masura si control

- Menghine

- Pile, polizoare

- Pistoale cu aer

- Pistoale pentru silicon

- Pistoale pentru spuma

- Prese

- Roabe

- Scripeti, corzi, sfori…

- Scule depanare auto

- Scule pentru cuie

- Scule pentru marcari

- Scule pentru taiat, decupat

- Scule pentru vopsit

- Scule pentru zidarie

- Scule speciale

- Scule tamplarie

- Surubelnite

- Surubelnite electrice

- Țeavă

- Sisteme de avertizare

- Uz casnic si gospodaresc

Filtrare produse

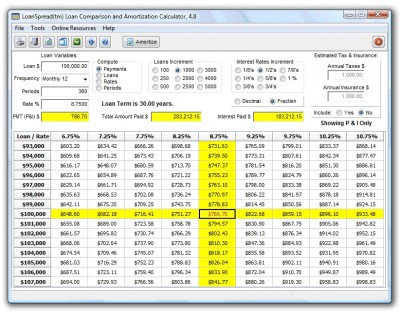

Whenever debating anywhere between leasing compared to. to buy, you need to consider your lives and you may finances. While you are leasing provide a lot more freedom, owning a home enables you to create guarantee throughout the possessions and could promote tax advantages.

Loans as much as 85% out-of good home’s well worth appear on a purchase or re-finance no cash back, subject to assets kind of, a required minimum credit score and you can the absolute minimum amount of month-to-month supplies (i. Device constraints incorporate. Jumbo finance available around $9. Even more limits can get apply. Please contact good Chase House Credit Coach for information. Brand new DreaMaker mortgage is only available for purchase no-cash-out refinance out of a primary house 1-4 equipment assets getting 30-season fixed-rates terminology. Earnings limits and you will homebuyer studies direction required when all financial candidates are first-time homebuyers. FHA finance require a right up-top home loan top cash loans in Minnesota (UFMIP), that can easily be financed, or reduced on closure, and you will a keen FHA yearly home loan premium (MIP) paid off monthly also pertain.

Pros, Servicemembers, and you can people in the newest Federal Shield or Reserve may be qualified for a loan secured by the U. S. Institution out of Seasoned Factors (VA). A certificate of Qualification (COE) regarding the Virtual assistant is required to document qualification. Constraints and you will limits implement. An excellent preapproval will be based upon a look at money and you can advantage pointers you give, your credit report and you may an automated underwriting program comment. The latest issuance from an excellent preapproval page isnt financing partnership otherwise a vow for financing approval. We may provide that loan union when you fill out an application and we also manage a last underwriting feedback, also verification of any guidance given, assets valuation and you will, in the event that appropriate, investor approval, that may produce a switch to the newest regards to your preapproval.

Preapprovals aren’t available on all services may end shortly after 3 months. Contact a property Financing Coach getting facts. Assets browse is provided because of the HouseCanary, Inc. HouseCanary, powered by ComeHome, is not affiliated with JPMorgan Chase, N. An excellent. (Chase)eHome exists for you once the a complimentary. Chase is not guilty of the real house qualities and serp’s provided with ComeHome. Restrictions and you can restrictions affect new supply off Pursue MyHome. Units and you can calculators are supplied once the a courtesy so you can imagine your financial need. Show shown was estimates just. Speak with an excellent Chase Family Credit Mentor for more specific recommendations. Message and you may research prices will get use out of your service provider. Crucial Notice to Servicemembers in addition to their Dependents: It refinance bring may not be best for you for people who are entitled to professionals available with new Servicemembers Civil Save Work (SCRA).

While an enthusiastic SCRA-eligible customer and just have questions about this new SCRA or just around it refinance bring, excite seek the advice of your house Lending Coach. In the event that a great refinanced home loan possess a longer identity than just stays for the your existing mortgage, you will incur extra desire prices for brand new offered name. On the Changeable-Price Mortgage (ARM) device, attract is restricted to possess a flat time, and you will adjusts occasionally thereafter. At the end of the fresh repaired-price period, the attention and money could possibly get boost centered on coming index rates. The Apr get boost adopting the loan closes.

Most of the household lending products except IRRRL (Interest Cures Refinance loan) is at the mercy of borrowing from the bank and you can property acceptance

10. The newest apr (APR) is the cost of credit across the title of your own mortgage conveyed because an annual price. The latest Annual percentage rate found the following is based on the interest, one products, and you can home loan insurance having FHA financing. It doesn’t consider the handling fee or any most other financing-particular loans fees you will be required to shell out. Prices is estimated because of the county and you may real rates may vary. Rate, factors and Annual percentage rate tends to be adjusted based on multiple points, together with, although not simply for, county out of assets location, loan amount, paperwork variety of, loan type, occupancy types of, property kind of, financing so you can really worth along with your credit history. A final rate and you will affairs may be large otherwise less than men and women quoted centered on suggestions per this type of items, which are often calculated after you incorporate.

Equipment and you can hand calculators are supplied while the a complimentary to help you estimate their financial demands. Show revealed try quotes just. Talk to a beneficial Chase Home Financing Coach for much more specific pointers. Message and you may analysis rates will get apply out of your service provider.

FHA money need a right up-side financial premium (UFMIP), which can be funded, or paid off at closure, and you will monthly payments tend to pertain.

Extent it can save you towards the a good refinanced financial may differ from the mortgage

With the Changeable-Rate Mortgage (ARM) product, attract is restricted having a-flat time period, and you can adjusts occasionally after that. After the fixed-price months, the interest and costs get raise considering upcoming directory cost. The brand new Apr may raise pursuing the loan shuts.

The latest NMLS ID was an alternate character matter which is issued from the Nationwide Financial Certification System and you will Registry (NMLS) to each and every Mortgage loan Creator (MLO)

JPMorgan Chase doesn’t offer taxation information. Please speak to your income tax advisor towards deductibility of interest and you may most other costs.

Prices, program conditions and terms are at the mercy of changes without notice. Not totally all goods are obtainable in all the states and every amounts. Other constraints and restrictions pertain.